Championing inclusive growth and agricultural value-chain development that is accessible to everyone

Our solutions contribute to a robust and resilient agricultural sector by advocating for MSME-specific policies and improving the market linkages between farmers, traders, brokers, and buyers. Our specialisations include:

Gender-Inclusivity

Diverse, inclusive trade practices drive innovation, equality, and long-term economic sustainability in East Africa’s vibrant markets.

Youth Empowerment

Leveraging agricultural development as a driver of youth empowerment.

Agricultural Sustainability

Sustainable practices in agriculture strengthen value chains for impact beyond traditional project cycles.

Policy Advocacy and Localization

Advocating locally relevant policies to shape sustainable, community-focused agricultural value-chain development initiatives.

Digitalization & E-Commerce

Catalyzing market efficiency, connectivity, and innovation with accessible digital solutions.

Capacity Building

Fueling resilience and competitiveness by empowering local organizations and stakeholders with sustainable capacity building.

Our experience in East Africa's regional agricultural value-chains makes us experts in identifying and overcoming the barriers to inclusive and profitable participation.

Sauti’s experience deploying solutions at every level of agricultural value-chain, from farmers and producers to traders and buyers, gives us a unique insight into the ecosystem of private sector-led development.

Problems we target, which prevent MSME participation in effective agricultural value-chain development

Problem Statement

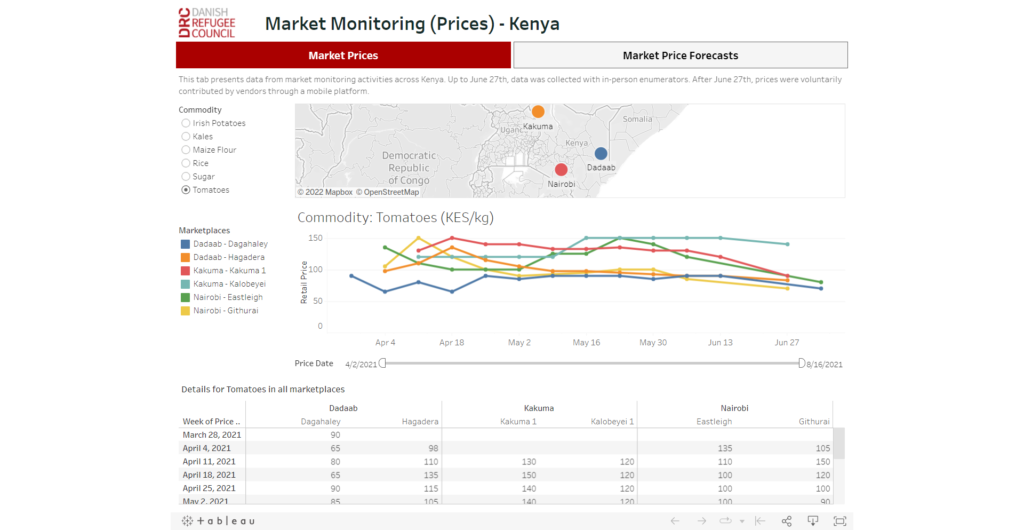

Challenges related to relevant, timely and accessible market information for Africa’s MSME traders add extra costs to participating in regional trade. Our research on Kenyan and Ugandan cross-border traders indicate that they spend an average of $8.70 per week on search costs (such as airtime for phone calls, internet or transport) to find the information they need to source goods from across the border. Moreover, the same research suggests that the cost burdens of search costs fall primarily on younger, less established, often women, informal traders who operate with smaller profit margins.

National consultations convened by the AfCFTA Secretariat, UNDP and UN Women found that 28 percent of women traders cited lack of knowledge of market opportunities as a major challenge to their ability to participate in cross-border trade. Most women traders in the 26 African countries surveyed had limited knowledge of trade opportunities and other potential supports that would be available to them in the context of AfCFTA, particularly among WMSMEs in rural areas.

The consequences of these accessibility issues have direct economic costs as traders spend more on traditional communication channels, such as phone calls with their social and professional networks, and create several indirect barriers that keep informal MSMEs from formalizing.

Problem Statement

Given the small volume-nature of informal MSME production, commodities often undergo a process of rural aggregation, at least some warehousing and bulk transport. High numbers of intermediaries in agricultural value chain means that commodities from different sources are often mixed together. Irregular storage standards between the variety of producers and intermediaries, such as traditional storage shelters, can fail to keep out produce-eating pests, nor control humidity and temperature variability, putting entire consignments of bulked commodities at risk of failing to meet required standards for formal export trade.

Agribusiness facilities (such as exporters and commercial processors) are also often located far from the sites of production and have specific moisture and quality standards before they can accept any agricultural produce. Similarly, at official border crossings, phytosanitary certificates are often required by the destination country to prove that the consignment has been inspected by agronomists and is free from harmful pests and plant diseases. Commodities may also sometimes be inspected at the border (for a fee), or in the absence of available equipment, may require samples to have been inspected beforehand by agronomists – typically only available in the originating country’s capital.

Problem Statement

High transfer costs associated with small volume transactions limit the market opportunities available to informal MSMEs. These transfer costs relate to the transport fees to cover long distances, market search costs and official trade costs, such as duties and tariffs, among others. With relatively smaller volume production, these transfer costs eat into a large share of MSME business profits, minimizing reinvestment and MSME opportunities to scale.

For informal MSME cross-border traders, small cash reserves mean they are unable to purchase stocks in bulk and must make frequent trips across the border – exposing them to the risks of corruption, harassment and insecurity. For farmers, who are frequently leveraged throughout the growing season, the revenues from small volume outputs leave little after paying seed borrowing fees.

Moreover, given that 95 percent of MSMEs depend solely on personal resources and loans from friends and relatives, credit from suppliers and peer lending, unexpected shocks to business revenue (made more pertinent with climate change) can have detrimental and community-level effects.

Problem Statement

Estimates for post-harvest losses in Africa vary between commodities but are commonly between 20 and 40 percent. Losses are concentrated further up the value chain, either on the farm or in processing and distribution. For agricultural goods, most commodities are lost during post-harvest handling and storage on-farm, while loss of fresh produce, meat and seafood is concentrated in processing, packaging and distribution.

One factor related to on-site post-harvest losses are the few opportunities producers have to preserve, process, mill, and add value to their production of raw commodities. While some farmers engage in on-site drying and storage before selling, commercial processing facilities are often concentrated near urban centres or major export ports. Many remote towns have traditional milling facilities, using stone grinders, mortar and pestle or steel plate grinding, which rarely produce outputs at the quality necessary for formal sector trade. Commercial millers, on the other hand, are often not accessible to MSME farmers because of producers’ small-volumes, relative distance and high transport costs.

The issue of access to value-add processors is more significant for commodities with faster spoilage times. Many livestock and animal products are impacted by the variability of seasonal climate conditions. Pastoralists, in particular, depend on a regular rainy season for water resources, nutrient-rich pastures, for consistent production. Moreover, women are often predominant in agricultural value-chains with faster spoilage times (e.g. fruits), compared to male dominated agricultural commodities (e.g. maize).

Agricultural Value-chain Development at an Unprecedented Scale

Our focus on reach and accessibility means that we have developed ICT-based approaches and services that impact significant numbers of MSMEs. We don't just target a few high-capacity MSMEs for impact, we implement base-of-the-pyramid solutions for a whole-of-system impact.

Supply Chain Mapping

- Identifying and mapping the entire agricultural value chain, from input suppliers to end consumers.

- Understanding the flow of products, information, and finances within the chain.

- Assessing the adoption of technology along the value chain, including precision farming, data analytics, and digital tools.

- Analyzing transportation, storage, and other logistics aspects of the value chain.

- Identifying key stakeholders in the agricultural value chain, including farmers, processors, distributors, retailers, and consumers.

Market Linkages and Access

- Analyzing market dynamics, including demand and supply factors for agricultural products.

- Identifying opportunities to improve market linkages and access for smallholder farmers.

- Developing digital marketplaces to connect farmers with markets and buyers.

- Conducting cost-benefit analyses at each stage of the agricultural value chain to identify areas for optimization.

Capacity Building and Training

- Assessing the capacity and skills of stakeholders within the value chain.

- Designing and implementing training programs to enhance skills and knowledge.

- Digital literacy workshops to improve uptake and traction of new farming, market, and financial technologies.

Policy Advocacy and Compliance

- Evaluating existing regional or national policies related to agriculture and the value chain.

- Identifying key standards, regulations, and guidelines that impact local stakeholders

- Localizing policies to make them more relevant and applicable to the specific conditions of the region.

- Addressing communication barriers and ensure that the policies are easily understood by local farmers, professional organizations, and brokers.

- Publishing research to foster a community of practice focused on inclusive agricultural policy.

Digital Agriculture Solutions

- Implementing digital solutions for agricultural extension services.

- Develop analytics platforms to derive actionable insights from agricultural data.

- Train farmers and stakeholders in using digital tools for planning and decision-making.

- Digitizing supply-chains to ensure transparency from farm to market, enhancing product quality and consumer trust.

Sustainable Agriculture Practices

- Providing guidance on agroecological practices through digital platforms.

- Integrating locally precise climate data into digital platforms to support climate-smart decision-making.

- Communicating the benefits of good agricultural practices, such as diversification, pest control, and soil fertility

Financial Advisory for Farmers

- Developing interactive e-learning modules and mobile apps to educate farmers on financial management.

- Providing content on budgeting, savings, and investment strategies tailored to agricultural contexts.

- Empowering farmers with localized market and financial information to make informed financial decisions related to selling their produce.

- Connecting farmers with financial institutions willing to provide working capital based on future yields.

How we work

We leverage rigorous methods and robust data collection tools to uncover new ways to support innovation.

Design

Implement

Synthesise

Detailed scoping to understand objectives and tailor approaches

We apply our expertise in rigorous research and evaluation methods to help clients uncover better ways to use evidence. Our work can help:

- Understand which innovations work, why, where, and for whom.

- Design more inclusive and sustainable products/services for hard-to-reach communities.

Mobile data collection and analysis

We use mobile technologies to remotely collect real-time data (via SMS, USSD, and WhatsApp) with unprecedented precision and scale.

Drawing from practical experience as a leading innovator in East Africa, we also understand how to engage hard-to-reach populations to generate useful insights and analysis.

Actionable recommendations for innovators

We collaborate with project teams to ensure research deliverables are useful for innovation practitioners.

Whether your aims are to improve innovation design, engage stakeholders or create community buy-in within your organisation, we can help you to translate knowledge into practice.